USA Compression Partners, LP (USAC) has announced a major expansion move with the $860 million acquisition of private compression provider J-W Power Company, a deal expected to immediately strengthen the company’s financial profile and nationwide footprint.

Deal Structure: 50% Cash, 50% New Units

The transaction totals $860 million, split evenly between $430 million in cash and 18.3 million newly issued USAC units.

The cash portion will be funded through USAC’s revolving credit facility. A closing is targeted for early 2026, with expectations of a quicker timeline due to J-W’s private status.

J-W Adds Nearly 0.9 Million Horsepower

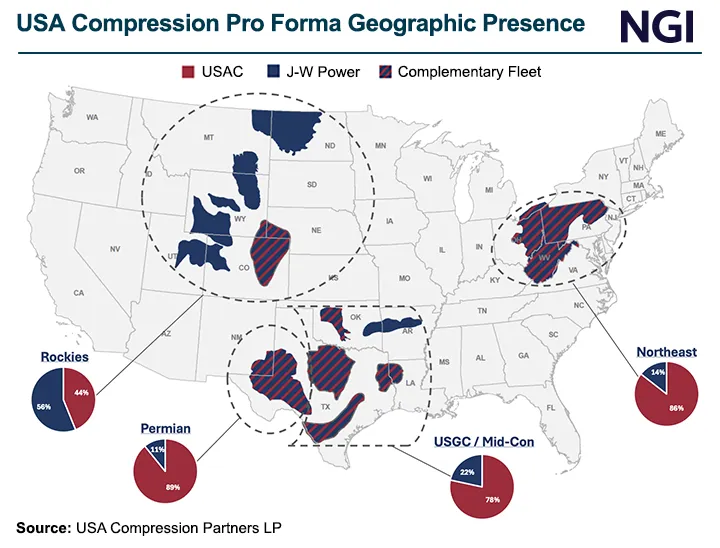

J-W Power brings 847,000 horsepower across key U.S. natural gas regions, including:

- Northeast

- Mid-Continent

- Rockies

- Gulf Coast

- Bakken

- Permian Basin

USAC noted that deployable horsepower could reach 900,000 HP with minimal capital investment, strengthening the combined company’s operating capacity.

Importantly, 90% of J-W’s 2025 EBITDA is secured through long-term contracts, providing strong revenue visibility.

Financial Impact: An Accretive Deal

The acquisition is immediately favorable to USAC’s metrics:

- J-W is being purchased at 5.8× 2026 estimated EBITDA.

- USAC currently trades at 8.9× 2026 standalone EBITDA.

- The combined company will trade at a lower 8.4× multiple, reflecting improved valuation and scale.

EBITDA per common unit will rise from $5.17 (standalone) to $5.50 (combined), with a similar boost expected in distributable cash flow.

Distribution Outlook & Debt Strategy

Despite the accretive economics, analysts do not expect USAC to increase its distribution in the near term. The partnership currently yields 8.3% with healthy coverage.

Instead, management is expected to prioritize deleveraging toward a sub-4× net debt-to-EBITDA ratio, especially with compression demand rising nationally.

Strategic Positioning Amid Growing Gas Demand

USAC’s acquisition comes as U.S. natural gas production surges to meet:

- Expanding LNG export demand

- Rising domestic power generation needs

- Infrastructure constraints that require higher compression capacity

Compression remains critical as a “bridge” solution until new pipelines are built later in the decade.